Italy

Generali confirms its leadership in the Italian insurance market with a total market share of 16.4% thanks to a complete range of insurance solutions for its customers in both the Life and the P&C segments. At distribution level, over the years Generali has perfected a multi-channel strategy heavily concentrated on agents. It also has a strong position in the P&C and Life direct channel, through Genertel and Genertellife, the first online insurance launched in Italy. Lastly, its partnership with Banca Generali allows it to offer a complete variety of insurance, pension and savings products to its customers.

The Group presents itself to the Italian market with three distinct brands having clear strategic positioning - Generali (retail and SME market), Alleanza (families) and Genertel and Genertellife (alternative channels). During 2017, Generali Italia further developed its simplification programme with the goal of improving the customer experience by simplifying the relationship between customers and agents for the entire process from pre-sales to assistance - and providing more accessible and innovative services.

Furthermore, at the end of 2017 Generali Italia launched Welion, a new services company focussed on providing advanced solutions in the world of individual health and corporate welfare.

With reference to the macroeconomic context, the Italian economy has exited its long recession; GDP growth for 2017 is estimated at 1.5%, supported by exports, a weak recovery in both domestic demand and in investments in machinery and equipment. The growth in disposable income caused by more favourable employment conditions is favouring household consumption.

In line with the trend observable during 2016, the Italian Life insurance market continued to fall also during 2017. New Life business continues to be mainly oriented toward the traditional products, even if it dropped sharply compared to the previous year (-18%) and significant growth in the unit-linked products (+33%) was noticed, even if the context continues to be characterised by volatility on the financial markets.

The P&C market also recorded worse performance this year due to strong competition amongst the various motor insurers, resulting in a further decline in average premiums. Benefiting from the macroeconomic recovery, though modest, positive growth rates on the other hand continued to be seen in the non-motor segment.

The domestic financial market was distinguished by growth in yield of the 10-year Italian bond, which closed 2016 at 1.8% to then settle at 2% at year-end 2017.

The Italian bond-German bund spread however fell from 1.6% at the end of 2016 to 1.5% at the end of 2017 owing to the improved macroeconomic condition of the country, also confirmed by the increased S&P rating from BBB- to BBB and to the measures taken to strengthen the Italian banking system.

The stock market was supported by strong global demand and accommodating policy of the ECB. FTSE MIB recorded positive performance (+14%) after having touched a maximum annual increase of 38% in September.

Protection (+14.9%) and unit-linked (52.1%) premiums recorded outstanding performance thanks to the new forms of hybrid investment that also benefited from the introduction of products having controlled volatility able to guarantee better investment stability. Traditional savings products went down (-13.5%), particularly the single premium ones, and this is in line with the strategic goal that prefers an underwriting policy more attentive to the absorption of capital.

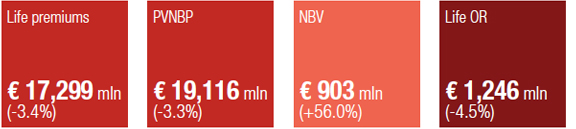

New business in terms of present value of new business premiums (PVNBP) amounted to € 19,116 million, down by 3.3%, mainly after the single premium policies fell (-7.9%) and annual premiums (-3.8%).

With reference to the business lines, unit-linked production improved considerably (+71.3% thanks to the contribution of the “hybrid” products) and growth of the protection line (+28.0%) was good. The savings products instead recorded a reduction (-18.8%), in line with the actions the Group took to reduce guaranteed business.

Profitability (margin on PVNBP) went up by 1.79 p.p., increasing from 2.93% of 2016 to 4.72% of 2017, mainly following the recalibration of the guarantees offered, the better production mix, the sale of new, more profitable hybrid products and a recovery of the financial situation.

The new business value considerably improved compared to the previous year (+56%) mainly due to the increase in profitability, despite the reduced volumes, and amounted to € 903 million.

Income decreased mainly because of the motor segment (-4.5%), which suffered the drop in new business linked to the profitability recovery policy in a market still going through a profitability crisis. The negative trend of non-motor segment (-1.8%) has to be entirely conducted to the Corporate and SME sector which is affected by strong competition on a soft market. The healthcare line grew thanks to the development initiatives that also led to the creation of Welion, a new company active in corporate welfare.

The combined ratio; is basically stable; the increase in the expense ratio, mainly linked to development of the non-motor portfolio, is almost entirely offset by the improvement in the current year loss ratio, while the contribution to the loss ratio from previous times is basically at the same levels of last year.

Germany

Generali Deutschland is the second insurance group in Germany in terms of total premium income. Its market share is 5.5% in the P&C segment and 9.6% in the Life segment (also including the healthcare business), with leadership positions particularly in the unit-linked and protection and corporate pension plans business lines, and in the direct channel.

In 2017, after having successfully concluded an early strategic and organisational revision (with the Simpler Smarter for You programme) ahead of schedule, Generali sped up implementation of the strategic plan in Germany by starting up the second phase of the strategic programme (Simpler, Smarter for You to Lead) with the objective of fully taking advantage of the growth and value creation potential in terms of:

- maximising operational efficiency with the creation of the “One company” model that calls for consolidating employees in two main companies, creating three product factories serving all distribution channels and significant management and corporate synergies and rationalisation of the brands portfolio;

- maximising distribution power: with integration of the channel of Generali dedicated agents in the DVAG network (the largest insurance distribution network in the country) that will operate under a new exclusive agreement to distribute the Generali brand products with strengthening of the direct channel (CosmosDirekt) through significant investments in simplifying processes and extending to new forms of digital brokering and with focus of the broker channel on profitability and the digitalisation process (Dialog);

- minimising the interest rate risk through the decision to put Generali Leben in run-off, releasing resources supporting growth in the German market.

During the year, the Group also further strengthened its positioning on the product innovation and customer services market owing to the Smart Insurance programme, which witnessed extension of the Generali Vitality programme to all distribution networks and the offer of telematics products (Generali Mobility), domotics products (Generali Domocity), legal protection and also owing to the digitalisation in the healthcare and claims services.

Difficulties persist in the German Life market due to the interest rates, which have remained for a long time at extremely low levels. In the P&C market, a stable market share with high business profitability by virtue of a combined ratio clearly better than the market is expected for Generali in Germany.

With reference to the financial markets, performance of the 10-year German bund, which closed 2016 at 0.2%, increased during 2017 to then close the year at 0.4%.

The DAX stock market also recorded a maximum in the summer to then close 2017 with 13% annual growth.

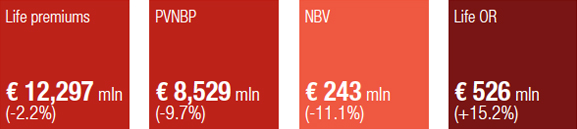

Life income showed a decrease of savings products (-10.0%), in particular the single premium one, consistently with the strategic actions implemented for the reduction of this product category in favour of the healthcare and unit-linked lines.

New business in terms of PVNBP decreased (-9.7%), caused by the drop in the Life segment (-10.7%); in the healthcare sector, on the other hand, growth was recorded (+10.9%). In looking at the business lines in detail, production of unit-linked products increased (+5.1%) while savings (-33.0%) products and risk products (-9.0%) decreased.

Profitability (margin on PVNBP) remained almost stable, from 2.89% of 2016 to 2.85% of 2017, owing to the good production mix and reduction of the guarantees offered. The new business value amounted to € 243 million (-11.1%).

The increase in income is attributable to the positive performance of the motor segment (+4.2%) that mainly benefits from the tariff policies on the existing portfolio, while the non-motor segment recorded a slight drop (-0.2%) linked to the reduction seen in the accident, healthcare and disability line.

The combined ratio shows a 2.6 p.p. worsening arising from the increase in claims following both the greater impact of major claims and the increase in claims tied to bad weather.

France

Generali France is a major player on the French market, with a multi-channel distribution network approach of agents, employed sales persons, brokers, financial advisors, banks, direct channels and affinity groups. The variety of the distribution channels reflects the features of the market and of the type of products distributed. This approach gained momentum after the Customer centric reorganization occurred in 2014, based on the creation of 4 separate client areas (Individual, Affluent, Professional & SME and Commercial). Another distinguishing element of Generali in the territory is its leadership in the Internet savings segment thanks to the excellence of the services provided and its important partnerships.

In 2017, the French economy displayed signs of recovery since the previous year, with estimated 1.9% growth of GDP yearly in real terms as compared to the 1.1% of last year. Although remaining at levels historically extremely modest, the interest rates recorded a slight increase that on the one hand reflects the growth of the GDP and, on the other, a certain recovery of the inflation, in line with what took place in the major European economies.

With reference to the financial markets, the performance of the 10-year OAT government bond was posted at 0.8% at year-end 2017 (0.7% year-end 2016). The stock market recorded steady growth (CAC40 +9%) thanks to the recovery of the production activities and consumption, but also supported by the considerable volume of liquidity on the financial markets.

On the whole, following a particularly positive 2016 in terms of demand, the sales of the Life insurance market decreased slightly (-2%) in relation to highly differentiated dynamics between the different products offered.

The traditional ones - En Euro policies - decreased by 11% as they were affected by the historically low level of yields offered, while the unit-linked policies recorded 35% growth, reflecting the policy of searching for customers of a more satisfactory risk/yield mix.

The dynamics of the P&C segment (+2.4% versus +1.8% of 2016) benefited from the economic recovery, although in the midst of increasingly lively competition and a soft phase in underwriting corporate business. The market was struck by various natural catastrophes with foreseeable negative consequences in the claims area.

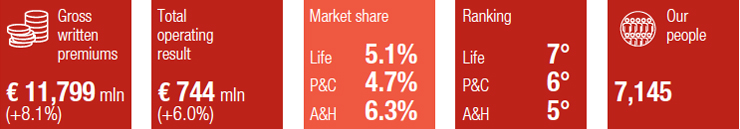

The growth in premiums is due to the dynamics of the unit-linked products (+52.1%) and of the protection line (+6.1%) that more than offset the decrease in traditional savings policies (-2.5%), in a market context made difficult by the low interest rate level. The considerable increase of the NBV is due to the change in business mix and a profound revision of the new products in order to improve their profitability.

Good growth of the PVNBP (+9.7%), driven by development of the annual premiums (+9.1%) and the excellent progression of the single premiums (+9.8%).

With reference to the business lines, excellent production of the unit-linked products (+55.7%) and good stamina of the risk products (+3.0%) was seen, to the detriment of the savings products (-7.3%).

Profitability (margin on PVNBP) recorded a sizeable increase, from 0.33% of 2016 to 2.26% of 2017, mainly thanks to the improved production mix in favour of unit-linked products with high profitability and the considerable reduction in guarantees offered on the savings business (representing 40.2% of production). The new business value amounted to € 211 million, also following the reduction in taxes (from 34.43% to 28.92% starting from 2020).

Slight increase in P&C income thanks to the motor segment (+2.6%) by virtue of the actions aimed at increasing both the number of policies in the portfolio and the average premium. The non-motor segment (-2.0%) instead suffered from the weak market conditions in the Companies and Buildings lines.

The reduction of the combined ratio reflects both improvement of claims and that of the expense ratio because of the measures taken in recent years, aimed at improving the technical profitability of the segment.

Compared to 2016, the impact of CAT claims remained unchanged.

CEE

CEE comprende Repubblica Ceca (Cz), Polonia (Pl), Ungheria (Hu), Slovacchia (Sk), Serbia/Montenegro, Romania, Slovenia, Bulgaria e Croazia.

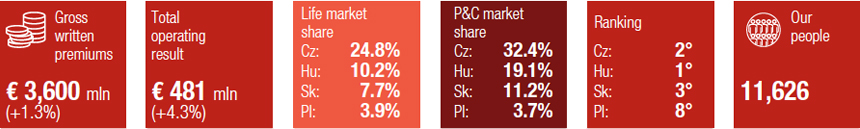

Generali CEE Holding is one of the biggest insurers in the Central Eastern European market. The Group ranks first in Hungary, second in the Czech Republic and Serbia, third in Slovakia and among the top ten in the other countries.

In terms of volumes, main insurance markets are Czech Republic, Poland, Hungary and Slovakia. The contribution of the minor markets has improved during the last years, resulting in an increase of the premium income on the total volume of the area.

Generali CEE is the best in the entire region and of the Group by technical profitability, with a medium-long term Combined Ratio at below 90%.

With reference to the Czech Republic, the most significant financial market of the Region for the Generali Group, the good performance of the macroeconomic situation continued in 2017, especially in the job market.

In April 2017, the National Czech Bank announced it was abandoning the cap at the exchange rate between Czech koruna and euro introduced in 2014 to prevent excessive strengthening, which would have fuelled deflationary pressures. As a result, it introduced an immediate fluctuation of the currency. Gradual recovery in the interest rates throughout the Region, together with the stock markets that are recording positive yields.

In 2017, insurance market volumes of the area declined in Life premiums, due for the most part to single premium policies, while there were positive developments in P&C premiums, driven for the most part by motor insurance.

With reference to the Life premiums of the CEE countries, savings products dropped (-3.6%, due to the performance of single premium policies), only partly offset by the positive development of the unit-linked products (+1.9%, supported by the growth in single premium policies). The trend of the Life premiums is explained by the slowdown in income in the Czech Republic (-3.4%, due to the strong competition between the main players of the market) and in Poland (-1.0%, linked to the complex legislative context and the company’s constant focus on greater profitability of the insurance business). Premium income in Slovakia is progressively growing (+7.7%), driven by protection products, in line with Group strategy.

New business in terms of present value of new business premiums (PVNBP) remained almost the same at € 881 million. At the business line level, unit-linked production decreased (-4.1%) despite the good production of the relevant single premiums (+11.4%), offset by the risk business production (+4.3%).

The rise in profitability (margin on PVNBP) from 9.05% of 2016 to 10.98% of 2017 is mainly explained by the increase in the profitability of the risk business, which represents 50.6% of production, higher than last year.

The increased profitability takes the new business value to € 97 million (+20.9%).

The 3.4% increase in P&C income is attributable to both segments. The motor segment (+3.2%) benefited from the tariff policies on the existing portfolio, while the nonmotor segment recorded 3.6% growth, in line with the Group strategy thanks to introduction of new home and travel products in the major markets of the area.

The improvement of the combined ratio, which decreased 1.7 p.p. compared to 2016, is mostly due to the lower net claims (-1.8 p.p.), thanks to the positive performance of prior years. The expense ratio stayed stable compared to the previous year (+0.1 p.p.), also benefiting from the lasting cost reduction measures.

Global Business Lines & International

In 2017, this business unit realised premiums amounting to € 16.3 billion and an operating result of € 1.2 billion. It is also the largest in terms of size, comprising over 20 countries grouped into three regions (Asia, Americas and EMEA) and four global business lines (GBL) of the Generali Group. The approach best suited to satisfying specific cluster of our customers is developed through GBL, in particular:

- Global Corporate and Commercial (GC&C): offers P&C insurance and services solutions to medium-large companies and brokers in over 160 countries around the world. Thanks to its solid global experience, knowledge of the local markets and the corporate sector, the unit offers integrated and personalisable solutions in property, casualty, engineering, marine, aviation and speciality risks. Through its experts in Multinational Programs, Claims and Loss Prevention, GC&C guarantees companies the same level of assistance and protection the world over.

- Generali Employee Benefits (GEB): strategic business unit of the Group present in more than 100 markets that deals with benefits for employees (local and expatriate), offering sophisticated solutions to multinational companies that want to protect their human capital with Life, accident, disability and health coverage and pension products.

- Generali Global Health (GGH): offers health insurance coverage all over the world to companies, international organisations and individuals needing to gain access to the best medical treatment without geographical boundaries. The products offered are distinguished by direct benefits and compensation, without prior disbursement by the policyholder, a modular and flexible structure and access to its network of over 1 million healthcare facilities;

- EuropAssistance (EA): major global brand for the assistance services focussed on innovation.

Global Business Lines & International is one of the growth engines for the Generali Group. The sections regarding the single regions are presented below.

EMEA includes Austria (At), Belgium, Greece, Guernsey, Ireland, Portugal, Spain (Es), Switzerland (Ch), Tunisia, Turkey and Dubai.

The Group’s main EMEA markets are Spain, Switzerland and Austria. In these territories the implementation of strategic initiatives focused on improving client centricity and the quality of service offered is on-going, with the aim to develop smart and innovative solutions in coherence with the Group strategy. An agreement to sell the entire stake in Generali PanEurope was signed in December, and the sale of the assets that the Group held in the Netherlands was finalised in February 2018. These transactions are part of the Generali Group’s strategy to readjust its geographical presence.

Spain

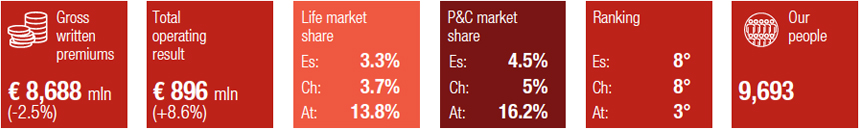

Generali has been in Spain since 1834 and currently exercises its presence with Generali España, a fully-owned subsidiary, and through two bancassurance agreements in a joint venture with Cajamar (Life and P&C) that ensure the Group exposure to the main Life distribution channel and continuous expansion in the P&C channel as well. Generali is one of the main insurance groups in Spain, with a total market share of 3.3% in the Life segment and 4.5% in the P&C segment. The Generali España group offers a wide range of Life and P&C policies dedicated to private individuals and companies, using a multi-channel distribution strategy including not only bank offices, but a network of agents and brokers which is among the most extensive in Spain. Overall, the Group ranks 8th in the Spanish insurance market in terms of total premiums.

With reference to the insurance market, the P&C segment continued to keep up its growth trend in 2017, also thanks to an overall macroeconomic recovery of the country. On the contrary, the Life market recorded a slow-down and decrease both in savings products and protection products.

Switzerland

Generali has been operating in Switzerland since 1987 and over the following decade its presence was consolidated by the acquisition and merger of many insurance companies. In accordance with the Group strategy, Generali Switzerland focuses on the retail business and provides high quality and innovative services, through various distribution channels: agents, brokers, financial advisors and direct channels. Generali Switzerland is the number eight insurance group in terms of premium income in the Life and P&C segments. The Life market share is 3.7%, while that of the P&C segment is 5%.

The Life insurance market recorded a slight decline, while the P&C market continued to grow, albeit weakly. More in general, the Swiss economy has always proven solid, even following the Central Bank’s decision to abandon the exchange rate floor. Following a period of stability in the beginning, in 2017 the Swiss currency slowly began to depreciate due to the euro appreciation (after the French elections), with the country’s desire to back export contributing.

However, the inflation rate is still close to 0% and the domestic GDP hovers around 1% in spite of the forecast progression for 2018.

Austria

Generali has been present in Austria since 1832, the year after the Company was established in Trieste. Generali operates in the country through the insurance companies Generali Versicherung, BAWAG P.S.K. Versicherung and Europäische Reiseversicherung. The multi-channel distribution strategy involves agents, brokers, financial advisors and banks (BAWAG P.S.K. and 3Banken). The Group strategy is reflected in the confirmation of Austria as market leader in the retail sector thanks to the focus on customers and on their needs and to the quality of services, offering simple and innovative solutions. Generali was the third largest insurance operator in terms of written premiums, with a market share of 13.8% in Life insurance and of 16.2% in P&C.

In general, a particularly complex economic situation marks the country and it is distinguished by low interest and inflation rates, and an unemployment rate in line with 2016 levels. As for the insurance market, price competition is very high, especially for the broker market, where a tendency to concentrate in pools is noted; difficulties in hiring a new sales force are seen and the comparative web portals are growing.

The trend in Life premiums is mainly explained by the slow-down of income in Spain (-10.1%) and in Switzerland (-2.4%), and this is for the most part attributable to the fall in traditional savings products, in line with the Group’s commercial strategy. Income from pure risk premiums experienced slight growth, especially in Spain and Austria.

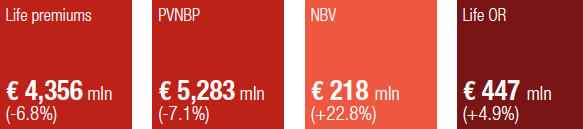

New business in terms of PVNBP was down (-7.1%), following the reductions in Switzerland (-36.1%), Austria (-4.2%) and Spain (-8.9%), with direct effects on the savings sector (-23.1%).

All in all, productivity enjoyed a considerable increase, from 3.16% of 2016 to 4.13% of 2017, mainly following the considerable reduction of traditional business (and of the financial guarantees offered) in favour of the risk business in Austria and Spain. New business value increased to € 218 million (+22.8%).

P&C premiums recorded slight growth in both segments, primarily due to Spain (+2.2%) and Austria (+2.8%). A drop in the motor business (-4.4%) was recorded in Switzerland, partly due to the reduction of the average premium, in line with the market context, and growth in the non-motor lines (+2.6%).

The improvement of the combined ratio is the result of the fewer claims recorded, in particular in Austria and Switzerland, and of the fewer costs, mainly in Spain.

Americas includes Argentina, Brazil, Colombia, Chile, Ecuador, Panama and the USA.

Argentina, where Generali ranks as the fourth operator, is the major market for the Group in this region. It is marked by a historically high inflation rate and a volatile financial situation, which has become accentuated following the political elections at the end of 2015. Nonetheless, starting from the second half of 2016 the economy began to show signs of stabilisation and opening up to the international markets; positive signals for the future of this key country on the Latin American continent.

Its economy, and inflation in particular, are stabilising due to the measures taken by the government. In such a tough scenario for the insurance business, the Group has implemented best practices in its Argentinian subsidiaries, enabling them to stand out in terms of service quality and innovation. The company Caja is the market leader, not counting the business lines where it does not operate (Workers Compensation and Annuities).

Brazil is the second most important country. Despite its systemic turmoil - a prolonged period of economic crisis and political instability from which the country appears to have left during 2017 - Brazil can boast an emerging middle class that represents development potential for the insurance market in the years to come. The Group also operates in Chile, Ecuador and the USA. During 2017, the sale of the shareholding in the Guatemala subsidiary was completed and agreements were reached to sell Colombia and Panama and they will be finalised in 2018.

Life volumes, mainly represented by protection products corresponding to 90% of total income, reported growth over 2016 (+14.7%) that was driven by Brazil’s performance (+37% owing to the contribution of new projects) and that of Argentina (+20% arising from increased insured sums consequent to the impact of inflation on wages).

New business in terms of PVNBP is down (-8.4%), while profitability (margin on PVNBP) was 1.42% with the new business value amounting to € 4 million2.

P&C income, 75% of which comes from motor policies, went up 19.2% mostly thanks to Argentina (representingabout 7 0% of the region) due to both the tariff adjustments resulting from the inflation and the higher number of

policies.

The combined ratio of the region was 105.5%, 2.8 p.p. worse than the previous year; this performance is attributablemainly to the strengthening of the reserves carried out in Argentina.

2 The NBV comes from the risk business in Argentina that for the first time was reported in 2017. After the Contract Boundaries rule was introduced, the Argentinian products have been classified as new business since the first quarter of 2017, while they were previously measured inside the existing portfolio.

Asia includes China, Indonesia, India, Hong Kong, Vietnam, Thailand, the Philippines, Malaysia and Japan.

The group has been present in Asia since the 1980s. It is currently operating in China, Indonesia, the Philippines, Hong Kong, Japan, Thailand, Vietnam, India and Malaysia. The companies present in these last two countries, as well as China company operating in the P&C segment, are not consolidated line-by-line as the relative shareholdings are not controlling. Hong Kong is also home to the regional office, which coordinates the entire area’s activities.

The Life income comes from China, Indonesia, Hong Kong, the Philippines, Thailand, Vietnam and India, and is concentrated primarily in the savings and protection segments and, to a lesser extent, the unit-linked segment. The P&C income, on the other hand, comes from China, India, Malaysia, Hong Kong, Thailand and Japan, with a premium volume which is in any event limited with respect to total income in the Region.

The banking and agency channels are enjoying rapid development, especially in China, and are the main distribution channels. The direct channel is still in the initial phases of development in China and Thailand. The main contributor in terms of sales and profit in the Region is the Chinese Life company, Generali China Life, a joint venture with the local partner CNPC, which today has become one of the top foreign insurance groups on the market.

Recently, the most significant transactions were the creation in July 2016 of a new Life company in Hong Kong, specialised in the High Net Worth segment, added alongside the branch and the regional office. The joint venture in the Philippines with the partner Banco De Oro was also closed in mid-2016, and at the same time a new company 100% owned by the Generali Group operating in the Group Life and Employee Benefits business was created. At the end of 2014 the Group entered the Malaysian market through an agreement with Multi-Purpose Capital Holdings Berhad (a wholly owned subsidiary of the Malaysian group headed by MPHB Capital) to acquire 49% of the P&C insurance firm Multi-Purpose Insurance Berhad (MPIB), with the option to exercise a call option on the additional 21% of MPIB in the future. Thus, the Generali Group would hold a 70% stake in the company, the maximum allowed for foreign companies in Malaysia.

Total premiums dropped by 3.8% at the end of 2017 (Life -4.3%, P&C +3.0%), basically due to several extraordinary effects that occurred in 2016, including the formation of a new company operating in the Life segment, whose un-derwritten business settled at levels below the initial ones following some delays in the process of approving products with the banking partners and a change in distribution strategy (from exclusive brokers to multibrokers), to resume momentum only starting from mid-2017.

The Life segment is driven by China, and more specifically by the savings products, even if the other countries also are demonstrating positive growth.

New business in terms of PVNBP is up (+6.0%) in all the countries; in particular, China (+14.1%) and Thailand (+58.9%) are enjoying good increases. With reference to the business lines, excellent development of the risk products (+75.1%) and good progress of the unit-linked products (+24.0%) was seen, at the same time the savings products decreased (-28.7%).

Profitability (margin on PVNBP) recorded a considerable increase, from 2.31% in 2017 to 7.00% in 2018, above all thanks to China that improved the business mix, with a resulting reduction of the guarantees offered on the savings business, and to improvement of the economic situation. The new business value amounted to € 140 million.

The P&C segment instead sustained the negative impact of CAT claims due to the corporate line of Hong Kong, bringing about an increase in the combined ratio of the region.

Global Lines

Global Corporate and Commercial

Created to develop P&C products and services for medium-large companies, Generali Global Corporate & Commercial offers complete insurance solutions to customers and intermediaries in over 150 countries through nine main offices in Europe, Asia and the Americas. With its global network of more than 1000 dedicated professionals and over 100 risk control experts, Generali Global Corporate & Commercial presents an integrated offer of insurance solutions that includes property, casualty, engineering, marine, aviation, cyber, financial risks and multinational programmes, generating a total premium volume of € 1.9 billion in 2017. From a technical viewpoint, the year’s performance was positive even though it was influenced by the occurrence of several CAT claims and the ongoing soft phase of the global corporate market marked by tariff pressures, tensions on the margins and heavy competition, above all in the property, casualty and engineering segments.

EuropAssistance

Major global brand for private assistance, this Group is specialised in offering insurance coverage and services in the travel, motor, home and family, and healthcare sectors. With over 300 million customers, Europ Assistance sets its goals on innovation and new markets, like that of Senior Care. The total income of the EA Group, calculated locally and including not only the gross written premiums but also revenue for assistance services and other activities, totalled € 1.6 billion in 2017. In 2017, the Group continued to pursue a growth strategy in both volumes and margins, considering that positive one-off effects linked to the sale of a non-core business unit were recorded the previous year.

Generali Employee Benefits

GEB is an integrated network that offers services for multinational company employee benefits consisting of pure risk, Life and health coverage and pension plans for both local and expatriate employees. Present in over 100 countries and with more than 400 coordinated multinational programmes (of which at least 40 captives), GEB today is the market leader for multinational companies with a premium volume of € 1.3 billion. GEB improved its performance in 2017 - and especially its technical performance - thanks to a successful Pool products (characterised by the centralisation of the customer’s international risks) campaign.

Generali Global Health

Generali Global Health (GGH) was created in 2015 as the brand and business unit of the Generali Group dedicated to the International Private Medical Insurance (IPMI) segment. Its premium income for the entire insurance market amounted to more than € 10 billion in premium at the global level, and compound annual growth of 13%.

More specifically, GGH realised a premium volume of € 0.1 billion in 2017 (+60% in 2016), in line with its strategic plan of becoming leader of the IPMI market by 2023.

GGH is distinguished by the innovative nature of its products and services, and by the high degree of digitalisation of processes. These features have already been acknowledged by the market, which awarded the company the title of Most Innovative Health Insurer at the recent 2017 International Insurance Forum.

Investments, Asset & Wealth Management

Coherently with the Group Asset Management Strategy announced in May 2017, the Business Unit was established in order to unify in a single entity the Group’s units operating in investments, asset management and wealth management. The ambition of the new business unit lies in expanding the customer base (mostly captive at the moment) to third–party clients, transforming the Asset management arm of the Group from an insurance services provider in a foremost player in the asset management industry.

The move, announced in 2017, towards a leaner, more efficient and more modern organizational structure, will allow the Group to:

- Exploit cross-selling and rationalization opportunities in order to reach a broader customer base increasing the weight of third-party customers, and to change the business mix by shifting to more capital-light products.

One such example is the launch of the Liability-Driven Investment Solutions, which aims to offer insurance investments advisory services, internally developed, to external institutional clients; - Create a solid and lean platform that facilitates the development of the Multi-boutique model, which consists in the creation of asset&savings management firms in partnership with expertise on niche asset classes and guarantees the interests alignment between the Boutiques’ management and the Group, alongside with limited risk for our shareholders.

The new business unit operates in three areas:

- Investment Management: implementation of Asset Liability Management (ALM) and Strategic Asset Allocation (SAA) models for Group Insurance Companies;

- Asset Management: asset management services targeted mainly at insurance clients, with the goal to widen the client base to third-party customers, both institutional (such as pension funds and foundations) and retail;

- Wealth Management: financial advisory and wealth protection services offered to private clients, mainly through Banca Generali Group.

The business unit’s Europe-based Assets under Management amounted to € 447bn as of YE17. Its net income increased from € 84m as of YE16 to € 152m as of YE177, in line with the announced 2020 target.

1 The indicated market shares and positions, based on written premiums, refer to the most recent official data.