This page contains Consolidated Non-Financial Statement information

Our remuneration policy is designed to attract, motivate and retain the people who - due to their technical and managerial skills and their different profiles in terms of origin, gender and experience - are key to the success of the Group, as reflected in our values.

Our remuneration policy reflects and supports both our strategy and values: to be a global insurance Group aiming at creating value and sustainable results, while valuing our people and maintaining commitments to all stakeholders.

The following principles lie at the heart of our remuneration policy and consequent actions:

The remuneration policy for non-executive directors establishes that remuneration consists of a fixed component as well as an attendance fee for each Board of Directors meeting in which they participate, in addition to the reimbursement of expenses incurred for participation in such meetings.

Directors who are also members of the board committees are paid remuneration in addition to the amounts already received as members of the Board of Directors (with the exception of those who are also executives of the Generali Group), in accordance with the powers conferred to those committees and the commitment required in terms of number of meetings and preparation activities involved. This remuneration is established by the Board of Directors.

In line with the best international market practices, there is no variable remuneration.

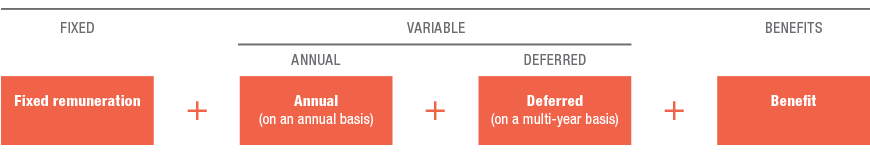

The Managing Director/Group CEO, the unique executive director, the members of the GMC and the other executives with key responsibilities receive a remuneration package consisting of a fixed component, a variable component with no-claims bonus and claw back mechanisms, and benefits.

Total target remuneration*

The fixed component remunerates the role held and responsibilities assigned, also considering the experience and skills required, as well as the quality of the contribution made in terms of achieving business results.

The short-term variable remuneration consists of an annual bonus system based on which a cash bonus of between 0% and 200% of the individual target baseline may be accrued depending on:

- the Group funding, connected with results achieved in terms of the Group Operating Result and Adjusted Net Profit and the surpassing of a minimum Economic Solvency Ratio** level

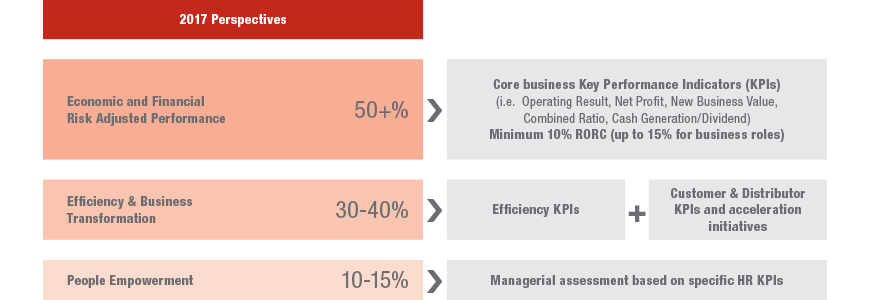

- the achievement of the objectives defined in the individual balanced scorecards, which establish from 5 to 7 objectives at Group, Region, country, business/function and individual level - as appropriate - based on the following perspectives:

The long-term variable remuneration is based on a long-term plan based on Assicurazioni Generali shares (upon approval by the Shareholders’ Meeting). The maximum potential bonus to be disbursed in shares amounts to 175% of the gross fixed remuneration of the participation (this percentage is 250% for the Managing Director/Group CEO). Here the features of the plan are:

- it is paid out over a period of 6 years and is linked with specific Group performance targets (Return on Equity and relative Total Shareholder Return) and the surpassing of a minimum Economic Solvency Ratio** level

- it is based on a three-year performance period and additional sale-restriction periods (i.e. minimum holding) on granted shares up to two years.

Benefits consist of a supplementary pension and healthcare assistance for employees and their families, in addition to a company car and further benefits, including some linked to domestic or international travel (e.g. accommodation expenses, travel and education for children), in line with market practices.

www.generali.com/governance/remuneration for further information on remuneration policy and the Remuneration Report, including also information about remuneration.

Additional information in the Notes of the Annual Integrated Report and Consolidated Financial Statements 2017 for further information on pension benefits of the Group employees.

*Remuneration package for all those described, with the exception of the executives with key responsibilities in control functions to whom specific remuneration policy and rules are applied.

**Regulatory Solvency Ratio as from 2018.