Liabilities

In accordance with the IAS/IFRS managerial model used by the Generali Group, consolidated liabilities were split into two categories:

- liabilities linked to operating activities, defined as all the consolidated financial liabilities related to specific balance sheet items from the consolidated financial statements. This category also includes liabilities stated by the insurance companies against investment contracts and liabilities to banks and customers of banks belonging to the group;

- liabilities linked to financing activities, including the other consolidated financial liabilities, including subordinated liabilities, bonds issued and other loans obtained. This category includes liabilities incurred in connection with a purchase of controlling interests.

Total liabilities were as follows:

Group debt

| (in € million) | 31/12/2017 | 31/12/2016 |

|---|---|---|

| Liabilities linked to operating activities | 30,501 | 28,445 |

| Liabilities linked to financing activities | 11,815 | 12,669 |

| Subordinated liabilities | 8,379 | 9,126 |

| Senior bonds | 2,980 | 3,017 |

| Other non-subordinated liabilities linked to financing activities | 456 | 526 |

| Total | 42,316 | 41,114 |

The decrease in the Group’s liabilities linked to financing activities was due mainly to the repayment of a subordinated bond issued by the subsidiary Generali Finance B.V. The repayment totaling € 869 million at nominal value was finalized by exercising an early repayment option on 8 February 2017.

Liabilities linked to operating activities recorded an increase due to the higher financial liabilities linked to investment contracts.

The weighted average cost of the liabilities linked to financing activities at 31 December 2017 totaled 5.70%, basically unchanged compared to the 5.67% of 31 December 2016. The weighted average cost reflects the annualized average cost of the debt considering the outstanding liabilities at the reporting date and the related currency and interest rate hedging.

Interest expenses on total liabilities are detailed below:

Interest expenses

| (in € million) | 31/12/2017 | 31/12/2016 | Change |

|---|---|---|---|

| Interest expense on liabilities linked to operating activities | 340 | 347 | -2.0% |

| Interest expense on liabilities linked to financing activities | 673 | 723 | -6.9% |

| Total(*) | 1,013 | 1,070 | -8.9% |

(*) Without taking into account the interest expenses on liabilities linked of the real estate development companies, classified among the other expenses, as well as the interest on deposit under reinsurance business accepted, deducted from the related interest income.

Details on the liabilities linked to financial activities

Details of subordinated liabilities and senior bonds

| 31/12/2017 | 31/12/2016 | |||||||

|---|---|---|---|---|---|---|---|---|

| (in € million) | Nominal value | Book value | Accrued interest expenses | Average weighted cost % | Nominal value | Book value | Accrued interest expenses | Average weighted cost % |

| Subordinated liabilities | 8,417 | 8,379 | 547 | 6.22% | 9,166 | 9,126 | 595 | 6.14% |

| Senior bonds | 3,000 | 2,980 | 125 | 4.19% | 3,000 | 3,017 | 125 | 4.18% |

| Total | 11,417 | 11,359 | 12,166 | 12,144 | ||||

* The weighted average cost reflects annualized cost of financial debt considering the outstanding debt at the reporting date and the related activities of currency and interest rate hedging.

Details of issues and redemptions of subordinated liabilities and senior bonds

| 31/12/2017 | 31/12/2016 | |||||

|---|---|---|---|---|---|---|

| (in € million) | Issuances | Redemptions | Issuances net of redemptions | Issuances | Redemptions | Issuances net of redemptions |

| Subordinated liabilities | 0 | 869 | -869 | 850 | 1,167 | -317 |

| Senior bonds | 0 | 13 | -13 | 0 | 0 | 0 |

| Total | 0 | 882 | 850 | 1,167 | ||

Details on principal issuances

Subordinated liabilities

Main subordinated issues

| Coupon | Outstanding (*) | Currency | Amortised cost(**) | Issue date | Call date | Maturity | |

|---|---|---|---|---|---|---|---|

| Assicurazioni Generali | 6.27% | 350 | GBP | 392 | 16/06/2006 | 16/02/2026 | Perp |

| Generali Finance B.V. | 5.48% | 869 | EUR | 0 | 08/02/2007 | 08/02/2017 | Perp |

| Assicurazioni Generali | 6.42% | 495 | GBP | 555 | 08/02/2007 | 08/02/2022 | Perp |

| Assicurazioni Generali | 10.13% | 750 | EUR | 748 | 10/07/2012 | 10/07/2022 | 10/07/2042 |

| Assicurazioni Generali | 7.75% | 1,250 | EUR | 1,247 | 12/12/2012 | 12/12/2022 | 12/12/2042 |

| Assicurazioni Generali | 4.13% | 1,000 | EUR | 990 | 02/04/2014 | n.a. | 04/05/2026 |

| Generali Finance B.V. | 4.60% | 1,500 | EUR | 1,340 | 21/11/2014 | 21/11/2025 | Perp |

| Assicurazioni Generali | 5.50% | 1,250 | EUR | 1,242 | 27/10/2015 | 27/10/2027 | 27/10/2047 |

| Assicurazioni Generali | 5.00% | 850 | EUR | 840 | 08/06/2016 | 08/06/2028 | 08/06/2048 |

(*) in currency million.

(**) in € million.

This category also includes unlisted subordinated liabilities issued by Assicurazioni Generali S.p.A. and other subsidiaries. Liabilities issued by Assicurazioni Generali S.p.A. in the form of private placements amounted to a nominal amount of € 1,000 million corresponding to an amortized cost of € 999 million. The remaining subordinated liabilities relate to shares issued by subsidiaries in Austria with an amortized cost of about € 26 million.

In February 2017 a subordinated bond issued by the group in February 2007 for the amount of € 869 million was repaid with the income from the issue of a subordinated bond for the total amount of € 850 million in June 2016.

Senior bonds

Main senior bonds issues

| Issuer | Coupon | Outstanding (*) | Currency | Amortised cost(**) | Issue date | Maturity |

|---|---|---|---|---|---|---|

| Assicurazioni Generali | 5.13% | 1,750 | EUR | 1,733 | 16/09/2009 | 16/09/2024 |

| Assicurazioni Generali | 2.88% | 1,250 | EUR | 1,247 | 14/01/2014 | 14/01/2020 |

(*) in currency million.

(**) in € million.

The bonds issued by the subsidiary Ceska Pojistovna for the nominal amount of CZK 500 million were repaid in December 2017.

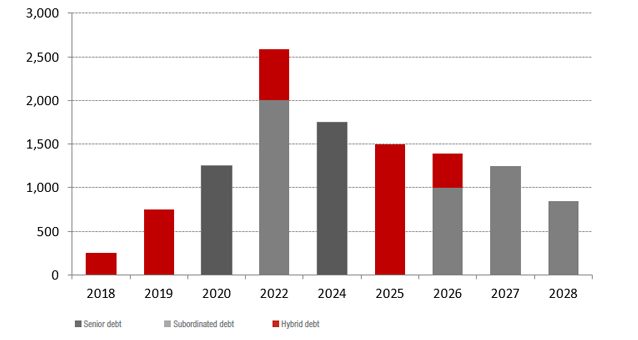

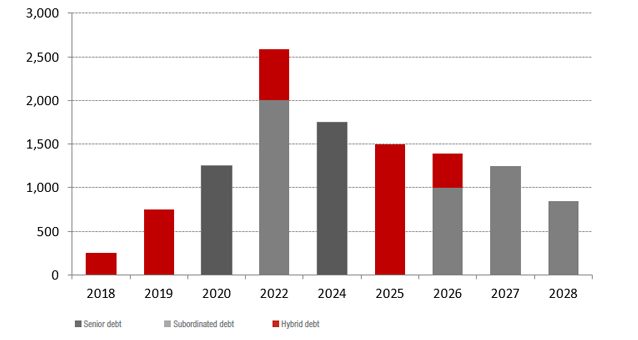

Maturity of the financial debt

The average duration at 31 December 2017 was 6.22 years compared to 6.72 years at 31 December 2016.

Lines of credit

As in established market practice for the sector, Assicurazioni Generali has a number of credit lines for the total maximum amount of € 2 billion with maturities in 2018 and 2020. The company intends to renew them.

The counterparties are major financial institutions of high international standing. This will only impact the Group’s financial liabilities if the facility is drawn down, and will allow Generali to improve financial flexibility to manage future cash requirements in a volatile environment.

Liquidity

Cash and cash equivalent

| (€ million) | 31/12/2017 | 31/12/2016 |

|---|---|---|

| Cash at bank and short-term securities | 6,143 | 6,210 |

| Cash and cash equivalents | 113 | 649 |

| Cash and balances with central banks | 593 | 606 |

| Money market investment funds unit | 6,891 | 4,000 |

| Other | -351 | -796 |

| Cash and cash equivalents | 13,390 | 10,668 |

Liquidity recorded an increase and amounted to € 13,390 million, mainly following the somewhat less favourable opportunities to reinvest profits generated particularly during the last part of the year.