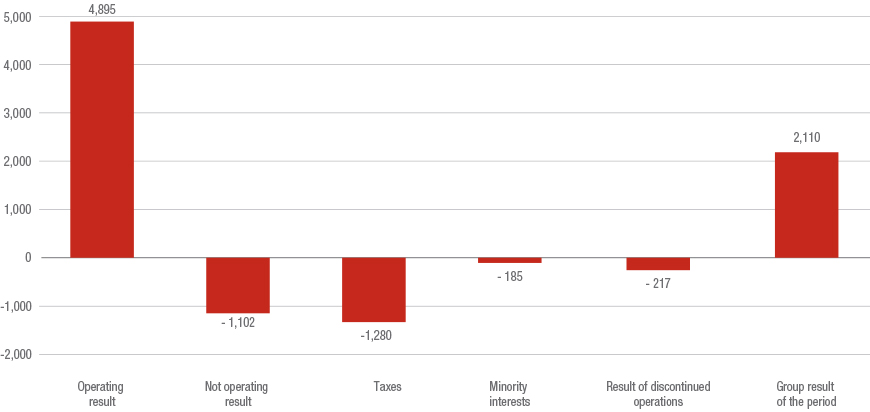

The result for the period attributable to the Group stood at € 2,110 million, showing an increase of 1.4% over the € 2,081 million recorded at 31 December 2016 and reflects:

- the improvement of the operating result and the development of the non-operating result noted above;

- the result of discontinued operations of € -217 million which includes the impairment of Dutch operations and the profit for the period deriving from said activities, plus the profit coming from the Irish company being discontinued;

- the increase in taxes, the tax rate of which came to 31.8% (29.4% at 31 December 2016), basically caused by the extraordinary additional tax introduced in France for 2017 for about € 40 million and the one-off substitute tax imposed by the US government on undistributed profits of the foreign investees of € 52 million. Last year the tax rate benefited from the reduced nominal tax rate on corporate income in Spain, as well as extraordinary income recognized in Germany against lower taxes on previous years;

- the result attributable to minority interests, amounting to € 185 million, which corresponds to a minority rate of 8.1% (7.1% at 31 December 2016), increased when compared to € 158 million in the previous year due to the results of Banca Generali.

From operating result to net result

| (€ million) | 31/12/2017 | 31/12/2016 | Change |

|---|---|---|---|

| Consolidated operating result | 4,895 | 4,783 | 2.3% |

| Net earned premiums | 64,604 | 64,944 | -0.5% |

| Net insurance benefits and claims | -65,748 | -63,616 | 3.4% |

| Acquisition and administration costs | -10,634 | -10,456 | 1.7% |

| Net fee and commission income and net income from financial service activities | 454 | 334 | 36.1% |

| Operating investment result | 16,993 | 14,245 | 19.3% |

| Net operating income from financial instruments at fair value through profit or loss | 4,365 | 2,164 | n.m. |

| Net operating income from other financial instruments | 12,628 | 12,081 | 4.5% |

| Interest income and other income | 11,874 | 12,029 | -1.3% |

| Net operating realized gains on other financial instruments and land and buildings (investment properties) | 1,957 | 1,698 | 15.2% |

| Net operating impairment losses on other financial instruments and land and buildings (investment properties) | -258 | -707 | -63.5% |

| Interest expense on liabilities linked to operating activities | -340 | -347 | -2.0% |

| Other expenses from other financial instruments and land and buildings (in-vestment properties) | -604 | -591 | 2.1% |

| Operating holding expenses | -454 | -458 | -0.9% |

| Net other operating expenses (*) | -321 | -208 | 53.8% |

| Consolidated non-operating result | -1,102 | -1,526 | -27.7% |

| Non operating investment result | 86 | -213 | n.m. |

| Net non-operating income from financial instruments at fair value through profit or loss | 26 | -96 | n.m. |

| Net non-operating income from other financial instruments (**) | 60 | -118 | n.m. |

| Net non-operating realized gains on other financial instruments and land and buildings (investment properties) | 331 | 425 | -22.1% |

| Net non-operating impairment losses on other financial instruments and land and buildings (investment properties) | -271 | -543 | -50.0% |

| Non-operating holding expenses | -756 | -794 | -4.7% |

| Interest expenses on financial debt | -673 | -723 | -6.9% |

| Other non-operating holding expenses | -83 | -71 | 17.7% |

| Net other non-operating expenses | -432 | -518 | -16.7% |

| Earning before taxes | 3,792 | 3,258 | 16.4% |

| Income taxes (*) | -1,280 | -1,059 | 20.9% |

| Earnings after taxes | 2,513 | 2,199 | 14.2% |

| Profit or loss from discontinued operations | -217 | 40 | n.m. |

| Consolidated result of the period | 2,295 | 2,239 | 2.5% |

| Result of the period attributable to the Group | 2,110 | 2,081 | 1.4% |

| Result of the period attributable to minority interests | 185 | 158 | 17.4% |

(*) At 31 December 2017 the amount is net of operating taxes for € 52 million and of non-recurring taxes shared with the policyholders in Germany for € 54 million (at 31 December 2016 respectively for € 64 million and € 79 million).

(**) The amount is gross of interest expense on liabilities linked to financing activities.