Gross written premiums and new business development

Gross written premiums in the Life segment, including premiums related to investment contracts, amounted to € 47,788 million, a 1% decrease over the previous year.

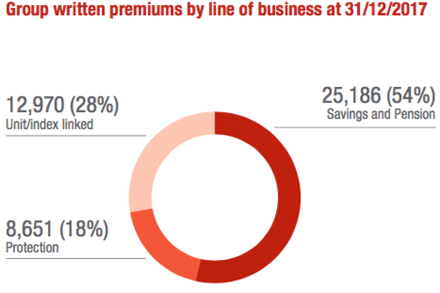

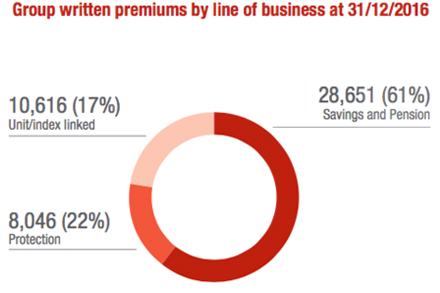

In line with the strategic objective of continuing the more selective underwriting policy, the sale of savings products decreased 11.6%, above all in Italy (-13.5%), Asia (-23.4%), Germany (-10%), Spain (-18.2%) and France (-2.5%).

The scheduled rebalancing in favor of products offering better risk-return terms brought about an increase in both unit-linked products (+22.4%) widespread in the Group’s areas of operations and especially in Italy (+57.3%) and France (+52.1%) and in the protection line (+7.0%), which show an overall increase in the Group countries.

Net cash inflows remained at the top market levels, reaching € 9,718 million. The performance (-17.1%) particularly reflects the decrease recorded in Italy (-20.8%) that was mainly due to the greater payments coming from surrenders, together with the above-mentioned decrease in premium income caused by the underwriting and rebalancing policies mentioned above. International income was also down (-57.9%), demonstrating a reduction in income, particularly in Asia and EMEA, together with greater payments.

New business in terms of present value of new business premiums (PVNBP) amounted to € 45,429 million, down by 2.3%, in both the single premium (-2.8%) and the annual premium policies (-2.6%). With reference to the business lines, unit-linked production rose sharply (+28.7%) and the protection line improved slightly (+3.0%). Savings and pension line premiums recorded a significant decrease (-19.0%) due to the Group’s scheduled actions aimed at reducing business subject to financial guarantees.

The new business value (NBV) improved significantly (+53.8%), standing at € 1,820 million (€ 1,193 million at 31 December 2016).

Profitability (margin on PVNBP) rose significantly by 1.46 p.p. to 4.01% (2.56% at 31 December 2016), of which +1.12 p.p. primarily due to the refocusing of sales towards the unit-linked and pure risk business and the effective recalibration of financial guarantees, and +0.34 p.p. arising from the economic environment better than last year.