Investments

Life segment investments

| (in € million) | 31/12/2017 | Impact (%) | 31/12/2016 | Impact (%) |

|---|---|---|---|---|

| Equity instruments | 12,685 | 3.6% | 13,089 | 3.8% |

| Fixed income instruments | 312,976 | 89.1% | 311,323 | 90.0% |

| Bonds | 287,320 | 81.8% | 284,936 | 82.3% |

| Other fixed income instruments | 25,656 | 7.3% | 26,387 | 7.6% |

| Land and buildings (investment properties) | 10,154 | 2.9% | 10,023 | 2.9% |

| Other investments | 5,815 | 1.7% | 4,743 | 1.4% |

| Investments in subsidiaries, associated companies and joint ventures | 4,120 | 1.2% | 3,917 | 1.1% |

| Derivatives | 980 | 0.3% | 197 | 0.1% |

| Other investments | 715 | 0.2% | 629 | 0.2% |

| Cash and cash equivalents | 9,787 | 2.8% | 6,910 | 2.0% |

| General accounts investments | 351,417 | 100.0% | 346,090 | 100.0% |

| Investment back to unit and index-linked policies | 75,372 | 21.4% | 67,340 | 19.5% |

| Total investments | 426,789 | 413,430 |

At 31 December 2017, total investments in the Life segment showed a 3.2% increase over 31 December 2016, amounting to € 426,789 million. Group investments amounted to € 351,417 million (+1.5%), while the investments related to the unit/index linked investments amounted to € 75,372 million (+11.9%).

The exposure in absolute terms towards fixed income instruments is up, standing at € 312,976 million (€ 311,323 million at 31 December 2016), with an incidence however increasing from 90% to 89.1%, while exposure to equity instruments decreased to € 12,685 million (€ 13,089 million at 31 December 2016). Investment properties of the Group in terms of book value rose to € 10,154 million (€ 10,023 million at 31 December 2016). Finally, there was an increase in cash and cash equivalents in both absolute and incidence terms standing at 2.8% (2% at 31 December 2016).

With reference to the breakdown of the bond investment portfolio, exposure to government bonds was slightly up, standing at € 162,150 million (€ 155,102 million at 31 December 2016), amounting to 56.4% of the bond portfolio (54.4% at 31 December 2016). The change for the period is due to the purchases made during the period, which are partially offset by the reduced value.

Corporate bonds also decreased to € 125,170 million (€ 129,834 million at 31 December 2016), equal to 43.6% (45.6% at 31 December 2016). This performance was mainly due to net sales carried out during the year.

Lastly, the average duration of the bond portfolio is 8.8 years (8.4 years at 31 December 2016), in line with the Group’s ALM strategy.

Life segment return on investments

| 31/12/2017 | 31/12/2016 | |

|---|---|---|

| Current return(*) | 3.1% | 3.2% |

| Harvesting rate | 0.7% | 0.2% |

| P&L return | 3.4% | 3.3% |

(*) Net of depreciations.

The current net current return from investments in the Life segment recorded a slight decline, falling from 3.2% at 31 December 2016 to 3.1% with the relative current income decreased to € 10,818 million (€ 11,113 million at 31 December 2016).

The contribution to the result for the period from the harvesting transactions increased at 0.7% (0.2% at 31 December 2016).

Life segment insurance provisions

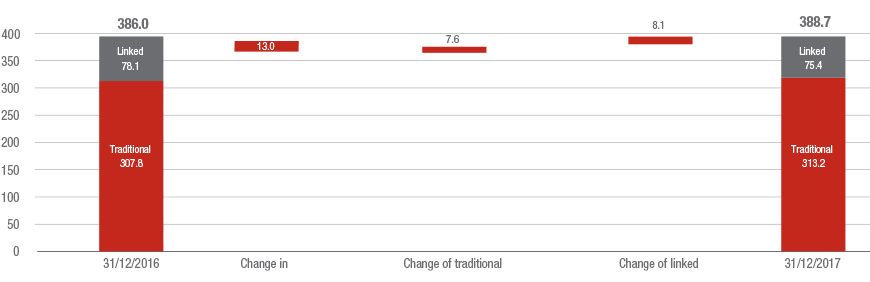

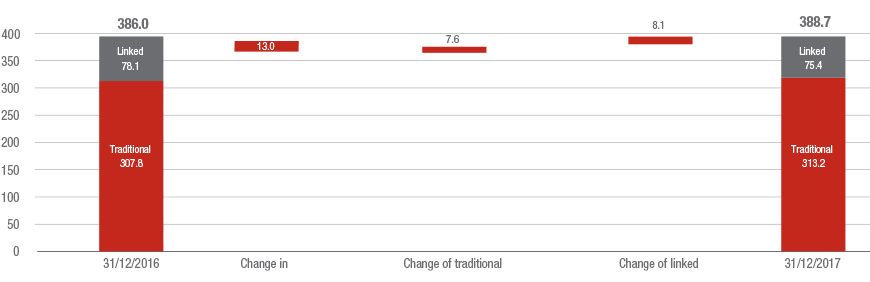

The technical provisions and financial liabilities of the life segment - not including deferred liabilities towards policyholders - amounted to € 388,660 million; the increase with equivalent consolidation area of +4.2% reflects the increase in reserves for the traditional portfolio (+2.5% equivalent consolidation area) as well as the linked portfolio (+12.1% equivalent consolidation area), and benefits from the combined effect of net inflows and financial market trends reflected in the trend of the unit-linked reserves.

Finally, deferred policyholders’ liabilities stood at € 21,231 million (€ 23,882 million at 31 December 2016), reflecting the change in the value of the investments, particularly in government bonds.