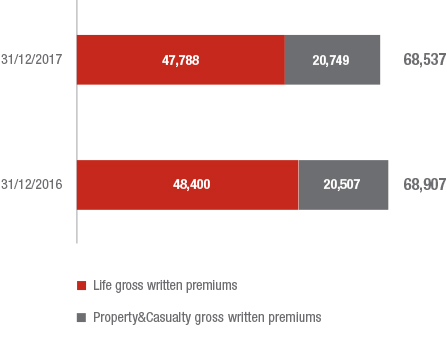

The Group’s gross written premiums totalled € 68,537 million (-0.2%), reflecting performance of the Life segment (-1.0%), while P&C (+1.7%) confirmed the development observed in 2017.

The Group’s gross written premiums totalled € 68,537 million (-0.2%), reflecting performance of the Life segment (-1.0%), while P&C (+1.7%) confirmed the development observed in 2017.

With reference to the lines of business, Life gross written premiums amounted to € 47,788 million (-1.0%). In line with the strategic goal of pursuing the more selective underwriting policy, premiums of savings products decreased by 11.6%, especially in Italy, Asia, Germany, Spain and France. The above-mentioned targeted rebalancing in favour of products offering better risk-return terms brought about an increase in both unit-linked products (+22.4%) widespread in the Group’s areas of operations and especially in Italy (+57.3%) and France (+52.1%), and in the protection line (+7.0%).

Net cash inflows surpass € 9.7 billion, staying among the market levels; the decrease of 17.1% reflects the aforementioned pursuit of the strategic objectives of concentrating sales on products with high profit margins.

New business in terms of present value of new business premiums (PVNBP) amounted to € 45,429 million, down by 2.3%, both in the single premium (-2.8%) and in the annual premium policies (-2.6%). With reference to the business lines, unit-linked production rose sharply (+28.7%) and the protection line improved slightly (+3.0%). Savings and pension line premiums recorded a significant decrease (-19.0%) due to the Group’s scheduled actions aimed at reducing business subject to financial guarantees.

The new business value (NBV) improved significantly (+53.8%), standing at € 1,820 million (€ 1,193 million at 31 December 2016).

New business margin on PVNBP1 rose significantly by 1.46 p.p. to 4.01% (2.56% at 31 December 2016), of which +1.12 p.p. primarily due to the refocusing of sales towards unit-linked and pure risk business and the effective recalibration of financial guarantees, and +0.34 p.p. arising from the improved economic environment compared to last year.

P&C premiums amounted to € 20,749 million, 1.7% higher because of the positive performance of both business lines. Development of the motor segment (+3.0%) is driven by the growth recorded in Germany (+4.2%), CEE Countries (+3.2%), Spain (+3.8%), the Americas region (+25.7%) and France (+2.6%), which more than offset the drop in motor premium income in Italy (-4.5%) after the average premium fell and after the measures taken to recover the returns of the portfolio. Also non-motor premium income is up (+0.9%) as it is mainly supported by development in the CEE Countries (+3.6%), in the EMEA region (+2.6%) and by Europ Assistance (+14.0%), while Italy, even if recovering from the drop seen in 2017, is down by 1.8%, mostly due to the reduction in the Global Corporate & Commercial lines. France fell 2.0% because of the weak market conditions in commercial and construction.

Insurance products, by their very nature, have a high social and environmental value given that they constitute a concrete response to the protection needs of customers and the growing needs of society, thereby promoting risk prevention and mitigation. We constantly monitor risks that may have impact on the society and the environment as to identify opportunities and continue to create value.

Risks and opportunities of the external context

As a consequence of such evaluation, we also develop products and services that - given the type of customer or provided coverage - meet specific social and environmental needs.

Glossary available at the end of this document

* Premiums with social and environmental value refer to companies representing 93.5% of total Group direct premiums.

Total gross written premiums

| (€ million) | Total gross written premiums | |

|---|---|---|

| 31/12/2017 | 31/12/2016 | |

| Italy | 22,836 | 23,612 |

| France | 11,799 | 10,920 |

| Germany | 16,005 | 16,227 |

| Central Eastern Europe | 3,600 | 3,490 |

| International* | 14,215 | 14,576 |

| EMEA | 8,688 | 8,960 |

| Spain | 2,427 | 2,502 |

| Austria | 2,592 | 2,568 |

| Switzerland | 1,817 | 1,883 |

| Other EMEA | 1,852 | 2,007 |

| Americas | 1,420 | 1,308 |

| Asia | 2,359 | 2,578 |

| Europ Assistance | 753 | 681 |

| Other | 996 | 1,048 |

| Group holding and other companies | 82 | 83 |

| Total | 68,537 | 68,907 |

* Total gross written premium for GBL & International, taking into consideration the Global Business Lines business underwritten in the various countries, amounted to € 16.324 mln. Overall, the Global Business Lines recorded € 4,102 million in premiums from:

- Global Corporate&Commercial € 1,887 mln;

- Generali Employee Benefits e Generali Global Health € 1,362 mln and

- Europe Assistance € 753 mln.

The description of the geographical areas presented in the document is available in the Note to the Management Report in the Appendices to Management Report section.

1 The margin calculated on Annual Premium Equivalent (APE) would amount to 39.2%.