Group performance and financial position

Group highlights1

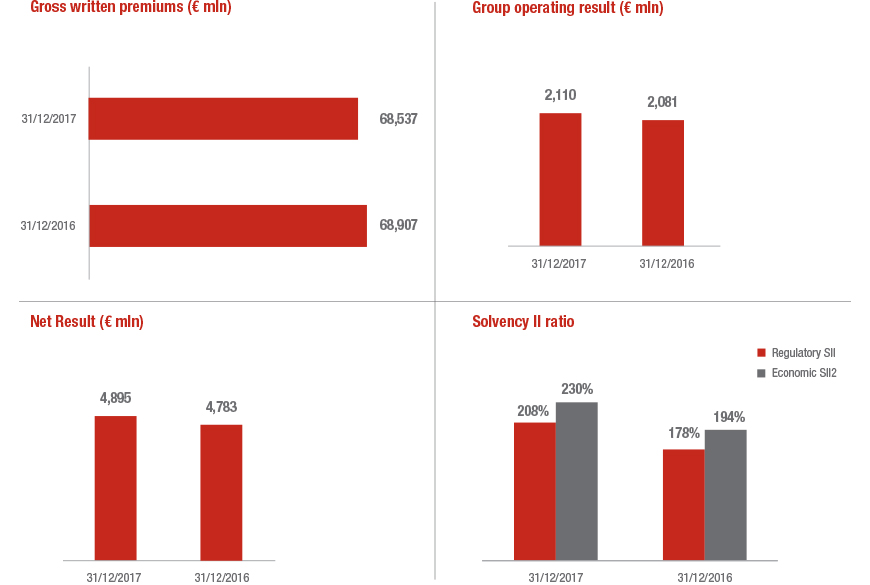

- Gross written premiums over € 68.5 bln (-0.2%), improving in P&C business (+1.7%). Life net cash inflows of more than € 9.7 bln, remaining at industry leading levels

- Operating result at € 4.9 bln (+2.3%) thanks to the performance of the Life and Holding and other businesses segments. The operating result of the P&C segment is solid, with its CoR confirmed at excellent levels (92.8%)

- Operating RoE at 13.4% confirming the achievement of the strategic target (>13%)

- Group result at € 2.1 billion (+1.4%)

- Further strengthened Group capital position, with the Regulatory Solvency Ratio at 208% and Economic Solvency Ratio at 230%

1 Changes in premiums, net cash inflows and PVNBP (the present value of new business premiums) are presented in equivalent terms, that is at constant exchange rates and scope of consolidation. With reference to the divestment of the Dutch and Irish assets in application of IFRS 5, the Dutch and Irish companies under disposal are classified as hed for sale. As a result, these shareholdings were not left out of the consolidation in the financial report at 31 December 2017, but both of the total of the assets and liabilities and the economic result – net of taxes – were separately recognized in the specific items of the financial statements. The 2016 comparative figures were likewise reclassified. For more information, please refer to the paragraph “Change in presentation of the Group performance measures” in the Note to the Management Report.