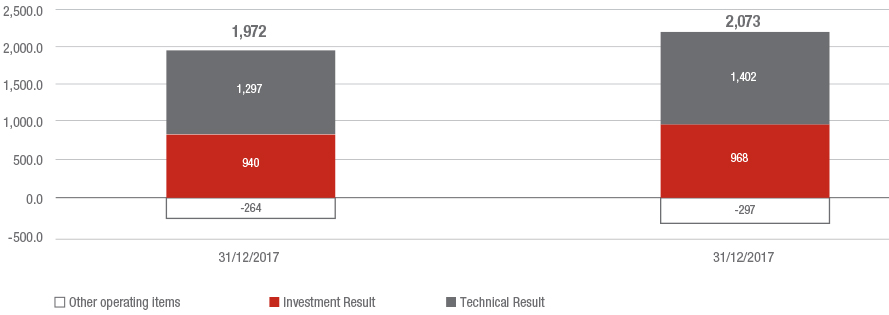

The P&C operating result stood at € 1,972 million (€ 2,073 million at 31 December 2016). The decrease observed (-4.9%) is mainly influenced by the increased impact of catastrophe claims for € 124 million.

The P&C operating return on investments was 5.0% (5.2% at 31 December 2016).

Technical result

Property&Casualty operating result: technical result

| (€ million) | 31/12/2017 | 31/12/2016 | Change |

|---|---|---|---|

| Technical result | 1,297 | 1,402 | -7.5% |

| Net earned premiums | 19,661 | 19,446 | 1.1% |

| Net insurance benefits and claims | -12,784 | -12,640 | 1.1% |

| Net acquistion and administration costs | -5,469 | -5,316 | 2.9% |

| Other net technical income | -111 | -87 | 27.4% |

The technical result stood at € 1,297 million, down compared to 31 December 2016 (-7.5%). This result includes the impact of catastrophe claims for about € 416 million, which mainly came from the US hurricanes and from the storms that struck Central Europe. Similar events had an impact of approximately € 293 million at 31 December 2016. The technical margin was negatively affected also by the increase in the acquisition costs following development of the premium volume previously remarked on, while the administration expenses decreased.

Technical indicators

| (in milioni di euro) | 31/12/2017 | 31/12/2016 | Change |

|---|---|---|---|

| Combined ratio | 92.8% | 92.3% | 0.5 |

| Loss ratio | 65.0% | 65.0% | 0.0 |

| current year loss ratio excluding natural catastrophes | 68.6% | 69.3% | -0.8 |

| natural catastrophes impact | 2.1% | 1.5% | 0.6 |

| prior year loss ratio | -5.6% | -5.8% | 0.2 |

| Expense ratio | 27.8% | 27.3% | 0.5 |

| Acquisition cost ratio | 22.3% | 21.5% | 0.8 |

| Administration cost ratio | 5.5% | 5.8% | -0.3 |

The Group combined ratio stood at 92.8% (+0.5 p.p. compared to 31 December 2016); the change is entirely due to the performance of the acquisition costs rate.

With reference to overall claims, which remains steady at 65%, current non-catastrophe claims improved 0.8 p.p. due to the improvement recorded in both business segments. The prior year loss ratio stood at -5.6%, down 0.2 p.p. compared to 31 December 2016. As usual, the Group maintained its prudent reserving approach, confirmed by the reserving ratio of 150%. The percentage of catastrophic claims was 2.1% compared to 1.5% in 2016.

Net acquisition and administration costs amounted to € 5,469 million (5,316 million at 31 December 2016). In detail, the acquisition costs increased to € 4,381 million (+4.6%), reflecting the increased costs resulting from the growth in premiums recorded in the Central-Eastern European countries and in France, and the increase in Germany, in the Americas and in EA following higher commissions in the travel business in Ireland and Spain. The ratio of acquisition costs to net earned premiums therefore increased to 22.3% (21.5% at 31 December 2016).

The administration costs of € 1,089 million on the other hand dropped by 3.7%, thanks to the reductions seen in EA and the Americas. The ratio of costs to net earned premiums was down at 5.5% (-0.3 p.p.).

Therefore, the expense ratio stood at 27.8% (27.3% at 31 December 2016).

Investment result

Property&Casualty operating result: investment result

| (€ million) | 31/12/2017 | 31/12/2016 | Change |

|---|---|---|---|

| Investment result | 940 | 968 | -2.9% |

| Current income from investments | 1,224 | 1,252 | -2.2% |

| Other operating net financial expenses | -285 | -284 | 0.3% |

The investment result in the P&C segment amounted to € 940 million, down compared to 31 December 2016 (-2.9%). In particular the current income from investments amounted to € 1,224 million (€ 1,252 million at 31 December 2016); this decrease is mainly attributable to the continuing context of low interest rates. However, the actions by the Group meant that it could achieve a current return of 3.1% (3.2% at 31 December 2016).

The change in current income is primarily attributable to the decline in income from fixed income instruments that fell from € 813 million at 31 December 2016 to € 762 million.

Current income from investment properties - net of depreciation - was stable at € 218 million (€ 220 million at 31 December 2016).

Income from investments in equity instruments increased compared to last year, up from € 86 million at 31 December 2016 to €114 million.

Other operating net financial expenses, which includes interest expense related to operating debt and investment management expenses, are in line with last year at € -285 million (€ -284 million at 31 December 2016).

Other operating items

Other operating items of the Property&Casualty segment, which primarily include non-insurance operating expenses, depreciation and amortization of tangible assets and multi-annual costs, provisions for recurring risks and other taxes, were down to € -264 million (€ -297 million at 31 December 2016) mainly due to lower operating allocation to the risk provisions.