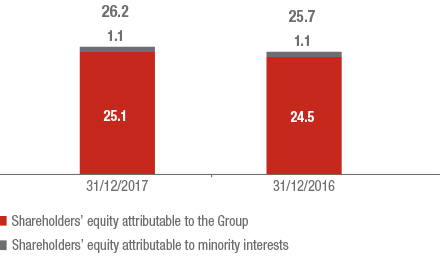

Shareholders’ equity attributable to the Group amounted to € 25,079 million, an increase of 2.2% compared to € 24,545 million at 31 December 2016. The change is mainly due to:

Shareholders’ equity attributable to the Group amounted to € 25,079 million, an increase of 2.2% compared to € 24,545 million at 31 December 2016. The change is mainly due to:

- the result of the period attributable to the Group, which amounted to € 2,110 million at 31 December 2017;

- the dividend distribution of € 1,249 million, carried out in 2017;

- other gains or losses recognized through shareholders’ equity in the current year amounted to € -100 million More specifically, this performance is mainly attributable to the reduction in profits or losses on exchange rates amounting to € -158 million.

Rollforward of Shareholders’ equity

| (€ million) | 31/12/2017 | 31/12/2016 |

|---|---|---|

| Shareholders' equity attributable to the Group at the end of the previous period | 24,545 | 23,565 |

| Result of the period | 2,110 | 2,081 |

| Dividend distributed | -1,249 | -1,123 |

| Other comprehensive income | -100 | 11 |

| Reserve for unrealized gains and losses on available for sale financial assets | -27 | 372 |

| Foreign currency translation differences | -158 | -31 |

| Net unrealized gains and losses on hedging derivatives | 58 | 13 |

| Net unrealized gains and losses on defined benefit plans | 31 | -224 |

| Other net unrealized gains and losses | -4 | -119 |

| Other items | -226 | 11 |

| Shareholders' equity attributable to the Group at the end of the period | 25,079 | 24,545 |

The Regulatory Solvency Ratio – which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the relevant approval from IVASS, and on the Standard Formula for other companies – stood at 208% (178% at 31 December 2016; +30pps).

The Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the entire Group perimeter, stood at 230% (194% at 31 December 2016; +36 pps). For further information regarding the Group’s solvency position, please refer to the Risk Report.